Why SoundHound Could Be the Next AI Stock to Rocket

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

From a penny stock trading at around $2 per share at the start of 2024, SoundHound AI (SOUN) stock has made significant gains, rising 693% to near $16.50 per share. The market typically rewards artificial intelligence companies that can combine rapid growth and innovation with a clear path to profitability. SoundHound checks all three boxes.

SoundHound AI just delivered its strongest quarter in company history, and the numbers suggest it may still be one of the most underappreciated growth stories in the mid-cap AI space. SOUN stock is down 17.6% year-to-date, underperforming the S&P 500 Index’s ($SPX) gain of 10.2%. Let’s dig in.

SoundHound AI: A Strong Growth Story

In the Q2 earnings call, CFO Nitesh Sharan called Voice AI the “spearhead” of the current generative AI era. The second-quarter numbers suggest that SoundHound’s technology, acquisitions, and integration capabilities are giving it a competitive advantage that is starting to translate into strong fundamentals. SoundHound reported $43 million in revenue, up 217% year over year, a rare level of growth in today’s market. This growth was not limited to one segment. SoundHound experienced significant growth across automotive AI, enterprise AI customer service, and restaurant AI automation.

SoundHound’s recent success can be attributed to Polaris, its multimodal, multilingual foundation model for conversational AI, which is the result of 20 years of research and development and data. Management stated that as customers migrate to Polaris, they notice immediate improvements in speed, accuracy, and user experience, resulting in high renewal rates, subscription expansions, and faster deal closures.

Many small-cap tech companies have ambitious acquisition plans but fail to integrate and monetize them. However, SoundHound has delivered on its acquisition by encouraging cross-selling solutions between acquired companies and existing customers, as well as replacing legacy technology with in-house Polaris models, lowering costs while increasing performance. In May, SoundHound launched Amelia 7, its agentic AI platform, powered by Polaris. Management stated that 15 large enterprise customers have already migrated to Amelia 7, and initial feedback indicates significant productivity gains.

Notably, the company’s proprietary technology and acquisition strategy are establishing a competitive advantage that may result in outsized returns for early investors. Although SoundHound is a growing company, it remains unprofitable due to aggressive AI investments and planned acquisitions. Its adjusted net loss came in at $0.03 per share, compared to a loss of $0.04 per share in the year-ago quarter. The adjusted EBITDA loss stood at $14.3 million. Continued cost discipline, combined with investments in generative AI capabilities and market expansion to boost revenue, could help the company be profitable. Management anticipates achieving adjusted EBITDA profitability by year-end 2025.

SoundHound AI ended the quarter with $230 million in cash and equivalents and no debt. The company raised its full-year 2025 revenue guidance to a range of $160 million to $178 million, in line with the consensus estimate of $166 million. Analysts expect revenue could further increase by 29.1% in 2026. Currently, SOUN stock trades at 30 times forward sales, which is high but reflects investor confidence in the company’s long-term prospects in the voice AI industry.

What Are Analysts Saying About SOUN Stock?

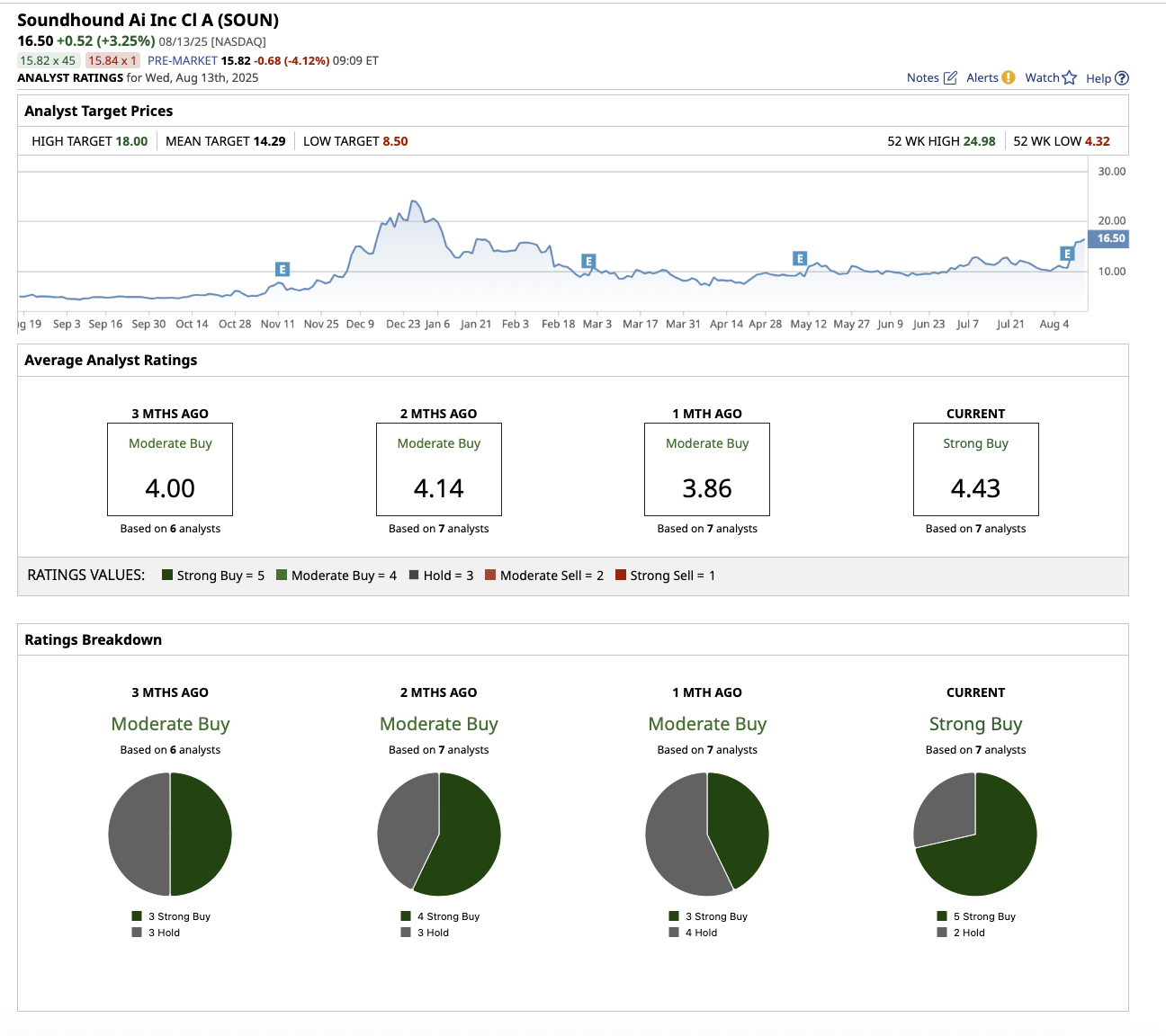

On Wall Street, SOUN stock is now rated as a “Strong Buy” compared to a “Moderate Buy” rating a month ago. Of the seven analysts covering SOUN, five give it a “Strong Buy” rating, while two suggest a “Hold.” The stock has surpassed its average price target of $14.29. However, the highest target price of $18 implies potential upside of 12.1% within the next 12 months.

Why Should You Eye This AI Stock?

While the company acknowledges that deal flow may cause quarterly revenue volatility, its long-term trajectory appears to be stable. SoundHound AI has the first-mover advantage in voice AI solutions. Voice commerce, while still in its early stages, has the potential to be SoundHound’s most explosive growth driver in the coming years. Management is striking a balance between aggressive market capture and disciplined spending, which could propel the company to become one of the standout mid-cap AI success stories of the coming years.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.