Cisco Exceeds Q4 Expectations, But Here’s Why You Shouldn’t Buy CSCO Stock Now

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

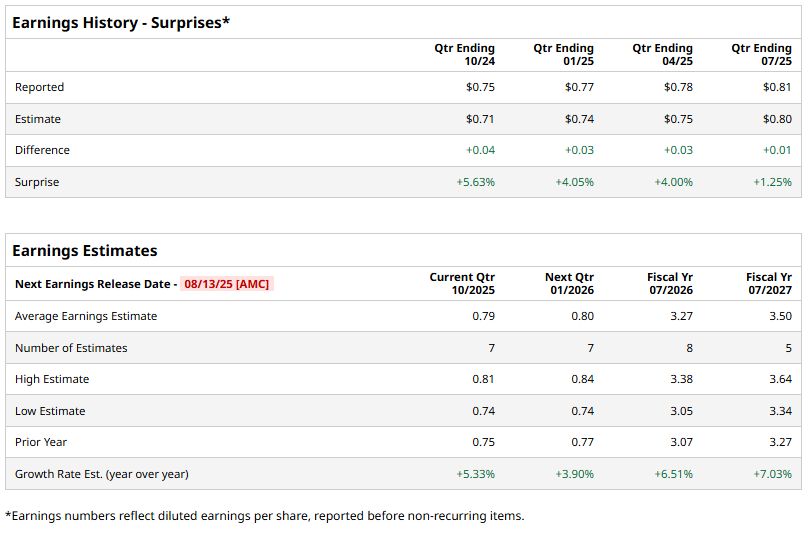

Cisco (CSCO) delivered a stronger-than-expected fourth quarter performance last night, extending its streak of topping Wall Street’s forecasts. Notably, CSCO has exceeded Street’s earnings expectations in the past four consecutive quarters, including a 1.25% beat in Q4.

While Cisco exceeded analysts’ expectations and is poised to benefit from artificial intelligence (AI)-driven demand for its next-generation networking solutions, investor enthusiasm was notably absent. CSCO shares showed little movement in pre-market trading on Aug. 14, a sign that the market may already have priced in much of the good news. The muted reaction points to the concerns over Cisco’s valuation, which appears stretched relative to its near-term growth prospects. Let’s take a closer look.

Cisco’s Growth Drivers Remain Intact

Cisco’s underlying business fundamentals appear strong, and AI-related tailwinds could continue to drive future growth. Its key growth catalysts showed solid momentum in Q4, setting the stage for sustained expansion.

In the fourth quarter, Cisco posted a 7% year-over-year increase in total product orders, with growth across all its markets. Enterprise product orders rose 5%, driven by a string of large deals with major corporations spanning various industries. Recurring revenue indicators also remained healthy, pointing to long-term growth and stability. Cisco’s total remaining performance obligations (RPO) reached $43.5 billion, up 6%, while product-related RPO climbed 8%. Short-term RPO stood at $21.7 billion, a 4% increase, and annualized recurring revenue hit $31.1 billion, growing 5% overall and 8% in products.

A significant growth catalyst for Cisco is the surge in demand from the AI infrastructure market. The company booked record AI infrastructure orders from large web-scale clients, totaling more than $800 million in the quarter. For fiscal 2025, these AI-related orders have already topped $2 billion, more than double the original $1 billion goal announced a year ago. This highlights the competitive edge of Cisco’s technology and its expanding relevance in powering critical AI-driven back-end systems.

Networking products remain another bright spot. Orders surged at a double-digit pace in Q4, marking the fourth straight quarter of such growth. The demand for its webscale infrastructure, enterprise routing, switching, industrial IoT, and servers remains strong, supporting future growth. Cisco’s customers are showing strong interest in its new Cat9k smart switches and its refreshed lineup of secure routers, ruggedized IoT devices, and wireless access points, all engineered for AI-ready campuses and branch environments.

Cisco’s next-generation smart switches deliver higher performance, quantum-secure networking, and simplified, AI-driven operations. Their launch signals the start of what could be a significant multiyear refresh cycle across Cisco’s vast installed base of campus switching infrastructure. Meanwhile, orders for its industrial IoT portfolio have grown at a double-digit rate for five consecutive quarters, and early indicators suggest demand will remain robust well into fiscal 2026.

Cisco Stock’s Valuation Limits Upside Potential

Cisco’s recent performance has been impressive, with the company benefiting from strong product demand and AI-driven tailwinds. These trends have given Cisco stock a healthy push. But when looking ahead, its growth outlook seems more measured than explosive.

Management is guiding for fiscal 2026 revenue in the range of $59 billion to $60 billion, which, at the midpoint, represents about a 5% year-over-year increase. This is in line with the growth registered in fiscal 2025 and shows no acceleration.

Cisco projects adjusted earnings per share (EPS) between $4.00 and $4.06 for FY26, which would mark about a 6% increase from the $3.81 it delivered in FY25. While this reflects consistent growth, it does not point to the kind of rapid acceleration that might excite the market.

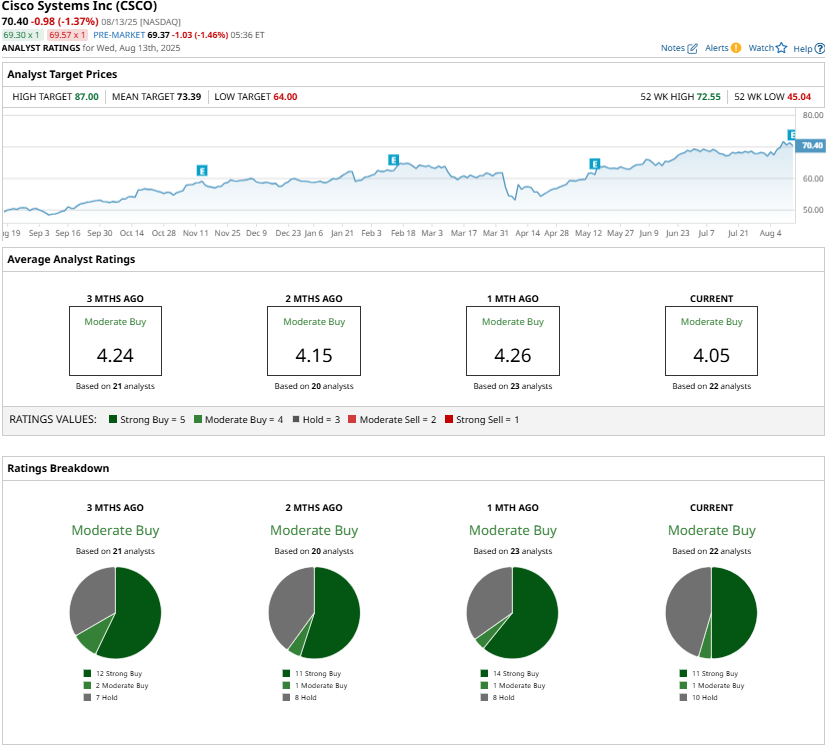

Investors have already rewarded Cisco generously, sending the stock up about 55% over the past year. However, at a forward price-earnings ratio of 21.8x, CSCO’s valuation appears stretched, with much of the good news already priced in the stock. Further, with management’s outlook indicating steady, but not rapid growth, the current valuation could limit the upside potential.

Bottom Line: Strong Fundamentals, But Priced for Perfection

Wall Street is cautiously optimistic about CSCO, keeping a “Moderate Buy” consensus rating. Cisco’s Q4 results and AI-driven momentum highlight its strong fundamentals and long-term growth potential. However, the stock’s stretched valuation and modest growth outlook temper the case for further near-term upside.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.