The Crypto-Famous Winklevoss Twins Are Betting Big on This 1 Bitcoin Stock

Cameron and Tyler Winklevoss, the billionaire co-founders of the cryptocurrency exchange Gemini, have made a strategic investment in American Bitcoin, a mining company with direct ties to the Trump family. Given the prominence of the Winklevoss twins in the cryptocurrency industry, this move merits a closer look at American Bitcoin.

American Bitcoin, co-founded by Donald Trump Jr. and Eric Trump, the sons of President Donald Trump, announced plans in May to go public through a merger with Gryphon Digital Mining (GRYP). The company is currently a majority owned subsidiary of Hut 8 (HUT), another Bitcoin (BTCUSD) mining firm. Hut 8 CEO Asher Genoot confirmed the Winklevoss investment, although the specific amount remains undisclosed. This investment deepens the brothers’ relationship with the current administration, following their $2 million contribution to Trump’s 2024 campaign and participation in key White House crypto events.

The twins attended the July signing ceremony for the GENIUS Act, which aims to regulate stablecoins, where Trump personally acknowledged their contributions. The timing appears strategic as Gemini filed for its own IPO in June after the SEC dropped its investigation into the company’s Earn program. With Trump appointee Paul Atkins chairing the SEC, the regulatory environment has become more favorable for crypto companies.

Hut 8 Is a Major Shareholder in American Bitcoin

Earlier this year, Bitcoin mining company Hut 8 announced a major partnership with Donald Trump Jr. and Eric Trump to launch American Bitcoin, a new mining venture aimed at becoming one of the world’s largest Bitcoin mining platforms.

CEO Asher Genoot said that the partnership represents a strategic spinoff of Hut 8’s Bitcoin mining and energy infrastructure businesses. American Bitcoin’s strategy focuses on low-cost mining, Bitcoin accumulation during favorable market conditions, and potential expansion into other Bitcoin ecosystem services. The venture aims to surpass Hut 8’s current holdings of over 10,000 BTC, worth approximately $1.2 billion.

Is Hut 8 Mining a Good Stock to Own?

In Q2 2025, Hut 8 reported revenue of $41.3 million, up 17% year-over-year, driven by infrastructure upgrades and the launch of American Bitcoin as a majority-owned subsidiary. The most notable development is Hut 8’s “Power First” strategy, positioning itself as an infrastructure provider rather than just a mining operator.

Nearly 90% of the company’s energy capacity is now commercialized under contracts of one year or longer, compared to less than 30% in Q2 of 2024. This shift provides greater revenue predictability and reduces exposure to Bitcoin price volatility.

Hut 8’s development pipeline spans approximately 10,800 megawatts and 3,100 megawatts under exclusivity, with sites designed for Bitcoin mining and AI computing workloads. The company’s greenfield development approach at projects like Riverbend demonstrates an ability to build purpose-designed infrastructure for next-generation compute demands.

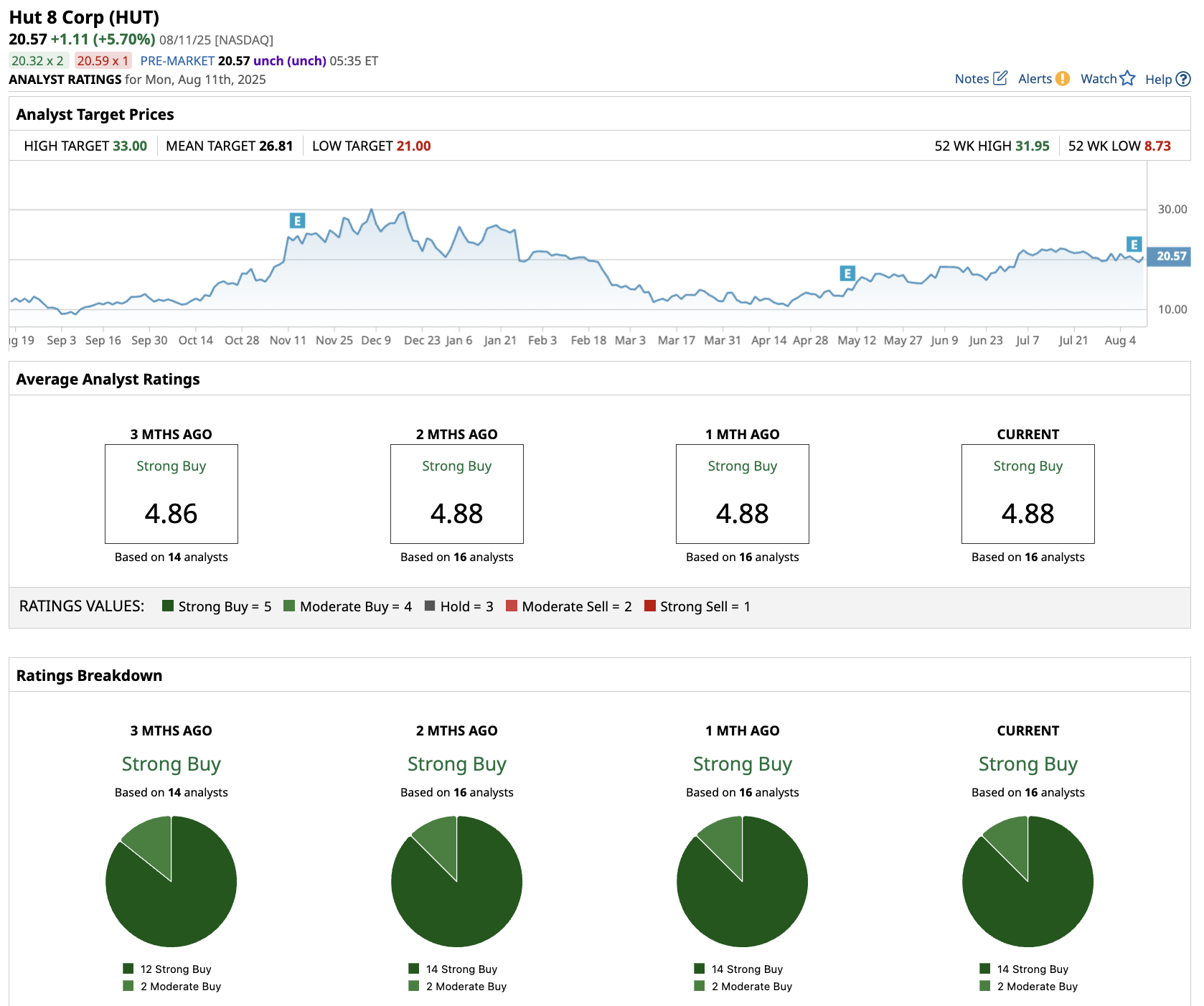

Of the 16 analysts covering HUT stock, 14 recommend “Strong Buy” and two recommend “Moderate Buy.” The average HUT stock price target is $27, 22% above the current price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.