1 ‘Strong Buy’ Dividend Stock to Buy to Protect Your Portfolio

While gold (GCZ25) is usually seen as a defensive asset and investors don’t really expect it to keep outperforming risk assets like equities over the long term, things have been different over the last few years. The precious metal is outperforming the S&P 500 Index ($SPX) this year, something it has also done over the last two-year and three-year periods.

Gold miners are a leveraged bet on gold as they tend to rise or fall more than the precious metal. We see something similar with other commodity producers, given their earnings sensitivity to the underlying commodity.

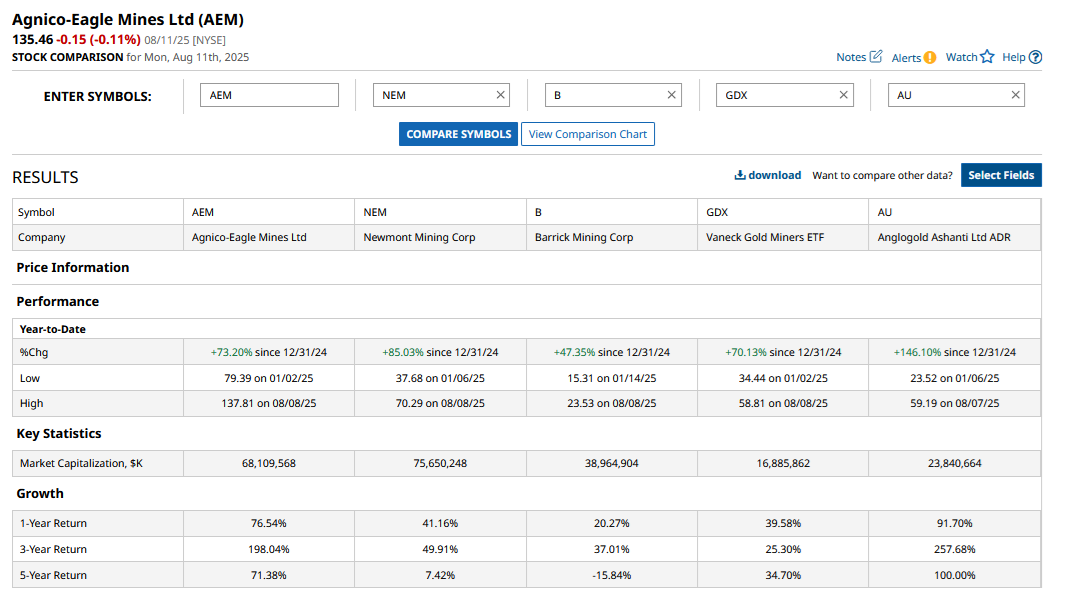

In the gold mining space, Agnico-Eagle Mines (AEM) is one name that looks like a good bet. The stock has outperformed the VanEck Gold Miners ETF (GDX) this year and looks set to continue its good run, as we’ll discuss in this article. But, before that, let’s look at gold’s outlook.

Gold Has Outperformed Stocks in 2025

Gold is a hedge against the volatile equity markets, and often the two assets tend to move in opposite directionntals. While stocks tend to do well in periods of economic boom and macro and geopolitically stability, the yellow metal outperforms when there is economic turmoil or geopolitical tension.

Over the last few years, though, both gold and the S&P 500 Index have been moving in tandem and rewarded investors. Notably, while the S&P 500 Index has hit record highs and put the tariff tantrum behind it, there are several risks that markets are wary of. These include a burgeoning U.S. national debt, geopolitical tensions as China and Russia push for a new world order, and the trade tensions which are testing the current global system.

While stock markets have learned to live with these issues, unless they seem to threaten the world economy in a significant way, investors are increasingly pivoting to gold to hedge their bets. Global central banks have also been increasing gold’s share in their foreign currency reserves, creating a tailwind for gold demand and, by extension, prices.

Why Agnico Eagle Mines Looks Like a Good Buy

AEM is one of the largest gold mining companies globally, with mines in “safe” jurisdictions in Canada, Mexico, Australia, and Finland. Its all-in sustaining costs (AISC) were $1,279 per troy ounce in Q2, and management reaffirmed the 2025 guidance of between $1,250-$1300 per troy ounce. The company is in the second-quartile of the global cost curve, which places it in a sweet spot, as it has good leverage to any upside in gold prices. On the downside, the company’s costs are significantly below what gold prices currently trade at, providing it ample cushion to survive any gold price slump.

AEM Has Paid Dividends for 42 Consecutive Years

While being a “non-yielding” asset is one of gold’s drawbacks, gold mining companies make it up through dividends. AEM has paid dividends for 42 consecutive years, and the bonanza is expected to continue as higher gold prices lead to an increase in earnings. In Q2 2025, Agnico-Eagle Mines generated free cash flows of $1.3 billion, of which it used $200 million for dividends and another $100 million for share repurchases. The company also pared its debt by $550 million in the quarter and now has a net cash position of almost $1 billion.

The company aims to return around a third of its free cash flows to shareholders in the form of dividends and share repurchases. It is also investing in organic growth, which bodes well for its production profile in the coming years. While the current dividend yield of 1.2% is a tad below the S&P 500 Index, AEM should increase the dividend either later this year or early next year as higher gold prices lift its cash flows.

AEM stock trades at a forward enterprise value-to-earnings before interest, tax, depreciation, and amortization (EV-to-EBITDA) ratio of 9.6x, which, although higher than its historical averages and some of its peers, is not yet frothy, given the structural tailwinds for gold prices. Moreover, Agnico-Eagle has historically commanded a premium over peers given its relatively safe business and strong balance sheet.

Overall, with a growing production profile, favorable position on the global cost curve, rock-solid balance sheet with a net cash position, and finally reasonable valuations, I find AEM a good dividend stock to buy.

Agnico-Eagle Mines Stock Forecast

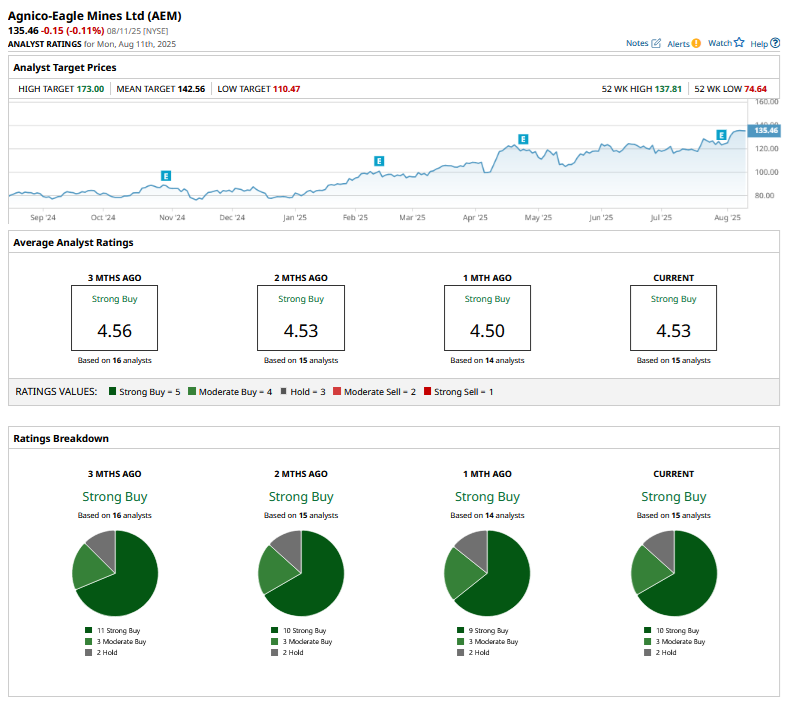

Brokerages are also quite bullish on AEM, and it has a consensus rating of “Strong Buy” from the 15 analysts covering the stock. AEM’s mean target price of $142.56 is 5.2% higher than the Aug. 11 closing price. The stock has continued to rally since the last time I covered it in June, and I expect it to build on its YTD gains in the coming months, even as there might be some downward pressure in the short term.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.