What Are Wall Street Analysts' Target Price for LKQ Stock?

/LKQ%20Corp%20magnified%20by-%20Casimiro%20PT%20via%20Shutterstock.jpg)

Valued at a market cap of $7.5 billion, LKQ Corporation (LKQ) is a prominent global distributor of alternative and specialty automotive parts. Headquartered in Tennessee, it specializes in distributing alternative, specialty, recycled, remanufactured, and aftermarket parts and systems for automobiles, trucks, RVs, and performance vehicles.

LKQ has significantly underperformed the broader market over the past year. LKQ stock plunged 21.7% over the past 52 weeks and 18% dip in 2025. In comparison, the S&P 500 Index ($SPX) surged 20.6% over the past year and 9.6% on a YTD basis.

Zooming in further, LKQ has trailed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 30.6% gains over the past year and 1.1% in 2025.

On Jul.24, LKQ Corporation reported Q2 2025 earnings, and its shares dropped 17.8% as LKQ lowered its 2025 guidance, citing weaker repairable claims in North America and challenging European market conditions, now expecting adjusted EPS of $3.00–$3.30 and a 1.5–3.5% decline in organic parts and services revenue. It posted revenue of $3.6 billion, down 1.9% year-over-year, with organic parts and services revenue falling 3.4%. Adjusted EPS also declined 11.2% to $0.87.

Analysts expect LKQ’s earnings to drop 10.9% year-over-year to $3.10 per share in the current year ending in December. However, the company has a mixed earnings surprise history, as it has beaten or met the consensus estimates in three of the past four quarters, while missing the estimate on another occasion.

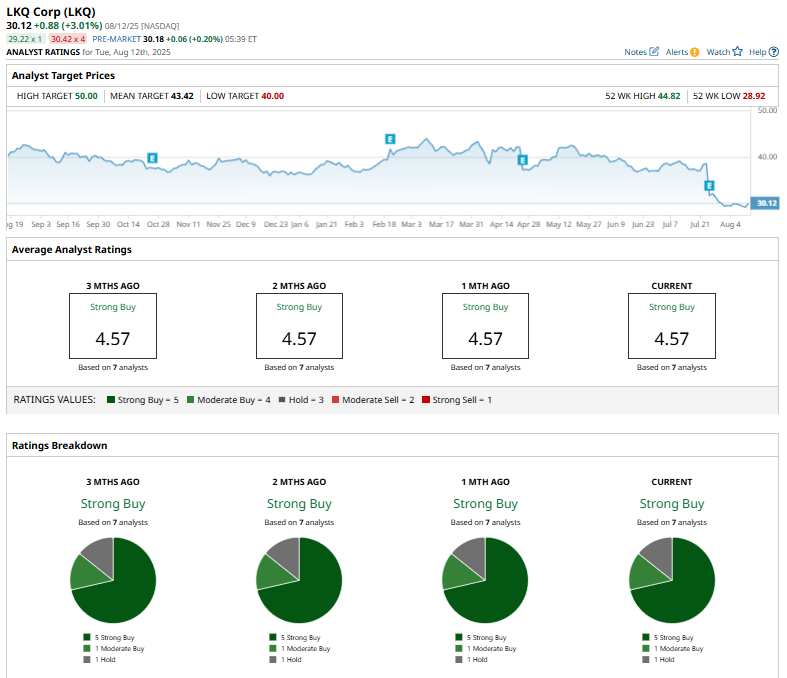

Among the seven analysts covering the LKQ stock, the consensus rating is a “Strong Buy.” That’s based on five “Strong Buy,” one “Moderate Buy,” and one “Hold” rating.

On July 25, Baird’s Craig Kennison cut LKQ’s price target from $48 to $42 but kept an “Outperform” rating, citing weaker Q2 results driven by challenges in repairable claims and softer performance in the European market.

LKQ’s mean price target of $43.42 represents a 44.2% premium to current price levels, while its street-high target of $50 indicates a staggering 66% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.