Trimble Stock Outlook: Is Wall Street Bullish or Bearish?

/Trimble%20Inc%20logo%20on%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

With a market cap of $19.7 billion, Trimble Inc. (TRMB) is a global technology company that provides advanced positioning, surveying, construction, and transportation management solutions. Leveraging GPS, GNSS, optical, laser, and wireless communications technologies, Trimble serves industries such as architecture, engineering, construction, logistics, and asset management worldwide.

Shares of the Westminster, Colorado-based company have outperformed the broader market over the past 52 weeks. TRMB stock has surged 62.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 20.1%. Moreover, shares of Trimble are up 18.5% on a YTD basis, compared to SPX's 8.6% rise.

In addition, shares of the navigation equipment maker have outpaced the Technology Select Sector SPDR Fund's (XLK) 29.6% return over the past 52 weeks.

Shares of Trimble rose 1.7% on Aug. 6 after the company reported Q2 2025 adjusted EPS of $0.71 and revenue of $875.7 million, above the forecasts. The company raised its annual revenue guidance to $3.5 billion - $3.6 billion and lifted its adjusted EPS outlook to $2.90 - $3.06. Investor optimism was further fueled by strong demand for its integrated hardware and software solutions, successful bundling of prepackaged product suites, and growing use of AI tools in customer workflows.

For the current fiscal year, ending in December 2025, analysts expect TRMB's EPS to grow 6.3% year-over-year to $2.35. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

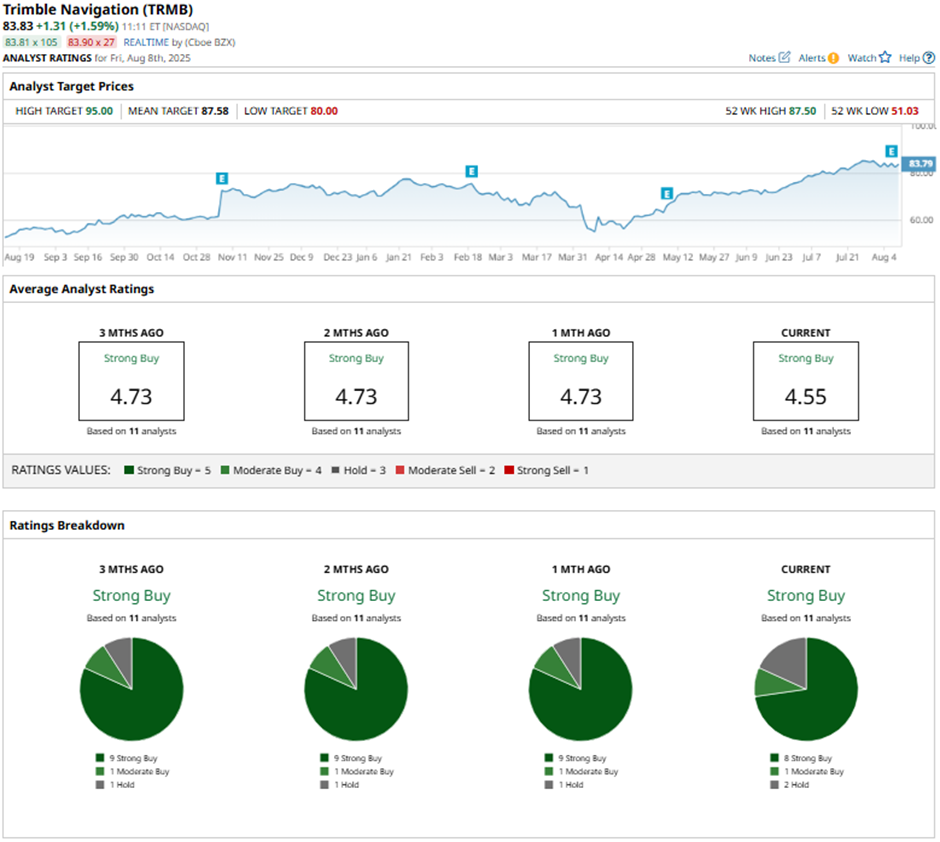

Among the 11 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” and two “Holds.”

On Aug. 7, Raymond James raised its price target on Trimble to $93, maintaining an “Outperform” rating.

As of writing, the stock is trading below the mean price target of $87.58. The Street-high price target of $95 implies a potential upside of 13.3% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.