What Are Wall Street Analysts’ Target Price for NiSource Stock?

NiSource Inc. (NI) is a leading regulated utility company headquartered in Merrillville, Indiana, with a market cap of approximately $20 billion. Operating within the Utilities sector and the Gas Utilities industry, NiSource provides natural gas and electric services to nearly 4 million customers across six U.S. states, including Indiana, Ohio, and Pennsylvania. The company focuses on delivering reliable, safe, and sustainable energy through its local distribution companies, while also investing in modernizing infrastructure and advancing clean energy initiatives.

NiSource has shown steady gains year-to-date (YTD), with its stock rising 15.3%, higher than the broader S&P 500 Index ($SPX), which has delivered about 7.8% returns over the same period. Over the 52-week span, NiSource again outperformed, reflecting investor confidence in the company’s regulated utility model and long-term growth strategy. It’s 36.2% gains compare favorably with the $SPX’s 21.9% returns. NI, in fact, hit its 52-week high of $43.51 recently, on Aug. 4.

Also, compared to the Utilities Select Sector SPDR Fund (XLU), NI showed greater strength. XLU has gained 14.4% YTD, while over the past 52 weeks, the ETF’s returns stand at 18.1%.

NI’s recent robust price action has been influenced by the company’s strong second-quarter earnings, positive analyst sentiment, and strategic investments in AI and renewable energy. In its second quarter of 2025 earnings report released on Aug. 6, NiSource delivered solid financial results that exceeded Wall Street expectations, reinforcing its position as a stable and well-managed utility.

The company’s revenue reached $1.28 billion, compared with $1.08 billion a year earlier and above analysts’ expectations. Also, the company’s non-GAAP EPS of $0.22 was slightly higher than the prior-year quarter value, and topped the consensus estimate. What further led to investors’ optimism is that the company narrowed its 2025 adjusted EPS guidance to the upper half of the $1.85 to $1.89 range, indicating confidence in achieving its financial targets.

For the current fiscal year, ending in December 2025, analysts expect NI to report EPS growth of 7.4% year-over-year to $1.88, on a diluted basis. The company has a history of surpassing consensus EPS estimates in its quarterly earnings reports, topping consensus estimates in each of the last four quarters.

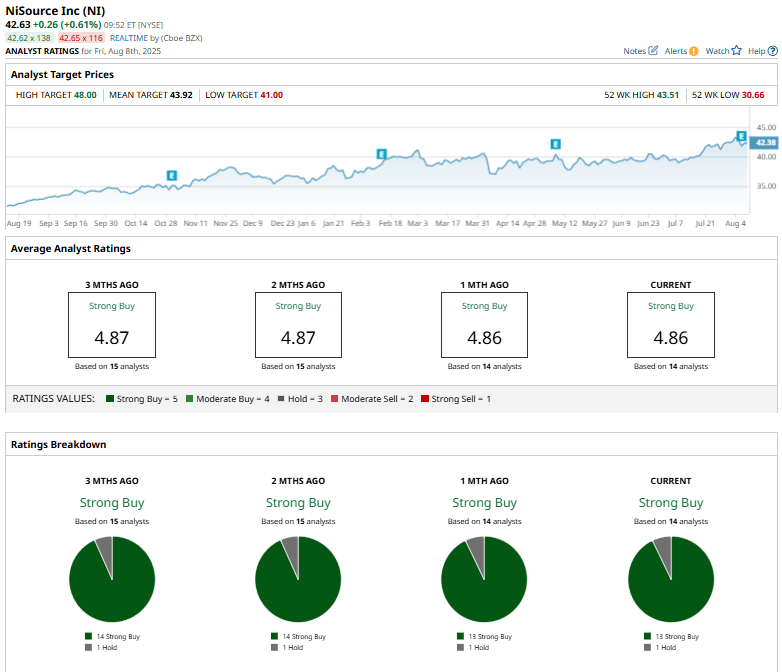

Of the 14 analysts covering NI stock, the consensus rating is a “Strong Buy.” That’s based on 13 “Strong Buy” and one “Hold” ratings.

The current configuration is more bearish than two months ago when 14 analysts gave “Strong Buy” recommendation for the stock.

On Aug. 4, Barclays plc (BCS) raised its price target on NiSource to $44 from $42 while maintaining an “Overweight” rating, citing upside potential from possible generation-related developments in Q3 2025 and anticipates progress in tariff outcomes that could enhance regulatory clarity.

While the mean price target of $43.92 represents a premium of 3.7% to its current price, the Street-high price target of $48 suggests an upside potential of 13.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.