Is Boeing Stock a Buy, Sell, or Hold for August 2025?

/Boeing%20Co_%20plane-by%20Wirestock%20via%20iStock.jpg)

After facing a crisis for years now, Boeing (BA) appears to be finding its footing again. While the deadly Boeing 787 Dreamliner crash in June brought intense public scrutiny, early findings suggest the company likely wasn’t to blame, offering a sigh of relief to BA stock investors. And even though speculations are still running wild around the plane crash, Boeing's latest earnings report provided a much-needed dose of optimism.

The company showcased solid topline growth and a sharp reduction in losses, thanks in large part to a surge in commercial aircraft deliveries. For the quarter ended June 30, Boeing delivered 150 airplanes, the highest number for a second quarter since 2018, which also was the last year Boeing turned an annual profit. This rebound in deliveries is a positive signal that Boeing’s core business is gaining momentum after years of disruption from regulatory and supply-chain challenges.

On the leadership front, CEO Kelly Ortberg acknowledged that transformation doesn’t happen overnight, but progress is already starting to take hold across the company. In fact, the CEO appears confident that if Boeing keeps its focus on safety, quality, and stability, 2025 could finally mark the long-awaited “turnaround year” for the company. So, with leadership setting sights on a comeback this year, would it be wise to bet on BA stock now?

About Boeing Stock

Boeing remains one of the most recognized names in aviation, with well-known aircraft like the 737 MAX, 787 Dreamliner, and the upcoming 777X forming the core of its commercial lineup. The company also maintains a strong presence in defense and space, contributing military aircraft, satellite systems, and launch technology. With a market capitalization of approximately $170 billion, the Virginia-based company remains a pivotal player in the global aerospace industry.

Despite being in the spotlight for all the wrong reasons, Boeing continues to play a central role in major global developments. Japan’s recent agreement to purchase 100 Boeing aircraft as part of a new trade agreement with the U.S underscores its enduring strategic importance in U.S. trade diplomacy. At the same time, Air India’s move to secure a $200 million loan for Boeing 777s shows that demand for the firm's aircraft hasn’t lost altitude, even amid ongoing scrutiny.

So far in 2025, Boeing shares have been flying high, outpacing the broader market with a gain of 27%, well ahead of the S&P 500 Index’s ($SPX) 8% return over the same period. BA stock even reached cruising altitude with a fresh 52-week high of $242.69 on July 29, before experiencing some turbulence with a pullback since that peak. Even with the dip, Boeing’s strong year-to-date (YTD) performance signals renewed investor confidence amid ongoing headlines.

A Look Inside Boeing’s Q2 Results

Boeing dropped its fiscal 2025 second-quarter earnings report on July 29, and it was a clear beat on both the top and bottom lines. Revenue for the quarter surged 35% year-over-year (YOY) to $22.7 billion, easily outpacing Wall Street’s estimate of $21.8 billion, driven by a sharp uptick in commercial deliveries. The company handed over 150 airplanes during the quarter, a hefty 63% jump from the same period last year, underscoring strong demand and operational momentum.

Boeing also showed solid progress on the bottom line. The company trimmed its GAAP net loss to $612 million, a sharp improvement from the $1.4 billion loss posted in the same quarter last year. Adjusted earnings told a similar story, coming in at a loss of $1.24 per share, far better than the $2.90 loss per share reported in Q2 of fiscal 2024. The figure also breezed past analyst expectations by a solid 19.5% margin.

Digging further into the results, Boeing’s Commercial Airplanes segment stole the show with revenue skyrocketing a remarkable 81% to $10.9 billion. The division secured 455 net orders, driven by major wins, including Qatar Airways’ purchase of the 787 and 777-9, as well as British Airways’ order for the 787-10, which signals strong global demand.

The Defense, Space & Security segment also held its ground, posting a 10% YOY revenue increase to $6.6 billion. Meanwhile, Global Services kept the upward trend going, with revenue climbing 8% to $5.3 billion. The unit, which supports both commercial and military clients with parts, maintenance, and training, continues to play a crucial role in Boeing’s diversified growth strategy.

Rounding out the quarter, Boeing’s total company backlog climbed to a towering $619 billion, up from $521 billion at the end of 2024. The bulk of that strength came from its commercial division, which now boasts over 5,900 airplane orders in the pipeline, offering a solid runway for future growth.

While reflecting on the Q2 performance, CEO Kelly Ortberg highlighted that the company’s deep-rooted changes to improve safety and quality are starting to show results, with more stable operations and better-performing products reaching customers. As the year progresses, the CEO is emphasizing Boeing’s focus on rebuilding trust and driving its recovery forward, all while adapting to an increasingly dynamic global backdrop.

What Do Analysts Think About Boeing Stock?

Wall Street’s conviction in Boeing’s comeback story is strengthening, as analysts grow increasingly bullish on the aerospace giant’s momentum. For instance, Bank of America raised its price target on Boeing to $270 and reaffirmed its “Buy” rating, citing the company’s growing role in U.S. trade diplomacy under President Donald Trump. The firm expects further global orders and noted that Boeing’s Q2 results were among its “cleanest” in years, with strong earnings and free cash flow.

Meanwhile, Susquehanna also struck a bullish tone, raising its price target on Boeing to $270 from $265 while maintaining a "Positive" rating. The firm believes Boeing’s Q2 performance is a key milestone in a vital turnaround year, driven largely by momentum in the Commercial Airplanes segment.

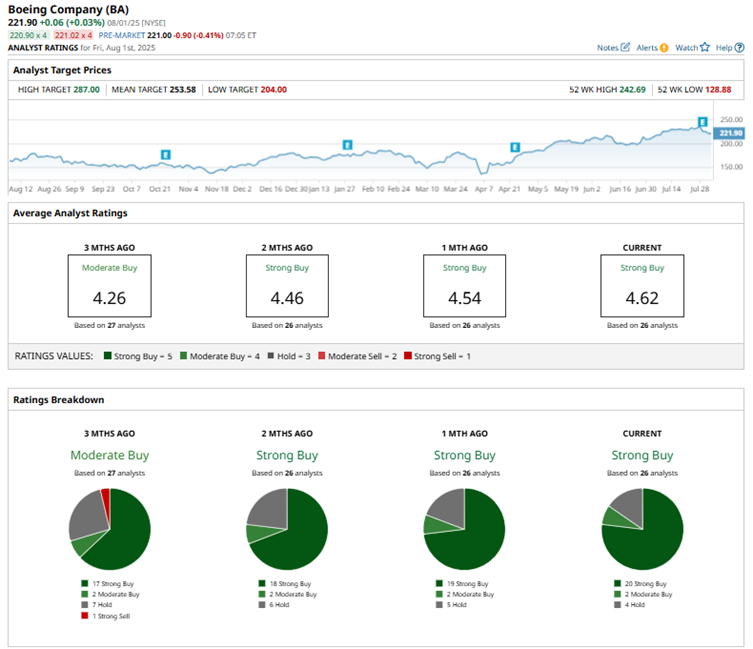

Boeing continues to win over Wall Street, earning a consensus “Strong Buy” rating as analysts grow increasingly confident in the company’s rebound and long-term prospects. Of the 26 analysts offering recommendations, a majority of 20 analysts advise a “Strong Buy,” two suggest a “Moderate Buy,” and the remaining four maintain a “Hold.”

BA stock’s average analyst price target of $254 suggests 13% potential upside from current levels. However, the Street-high target of $287 implies that shares can rally as much as 27% from current price levels.

Final Thoughts

With Boeing calling 2025 its turnaround year and backing it up with one of its strongest quarters in recent memory, Wall Street’s confidence is starting to soar. While headline risks still hover, the company’s improving fundamentals, booming aircraft deliveries, and growing analyst support paint a promising picture.

Even more promising is Boeing’s expanding role in U.S. trade negotiations, which could pave the way for a surge in global orders, similar to the deal recently struck with Japan. With multiple tailwinds now blowing in its favor, BA stock might just be worth a closer look for investors eyeing a rebound play.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.