This Dividend Stock Yields Almost 7.5% and Looks Set To Gain from Trump's Trade Deals: Time to Buy?

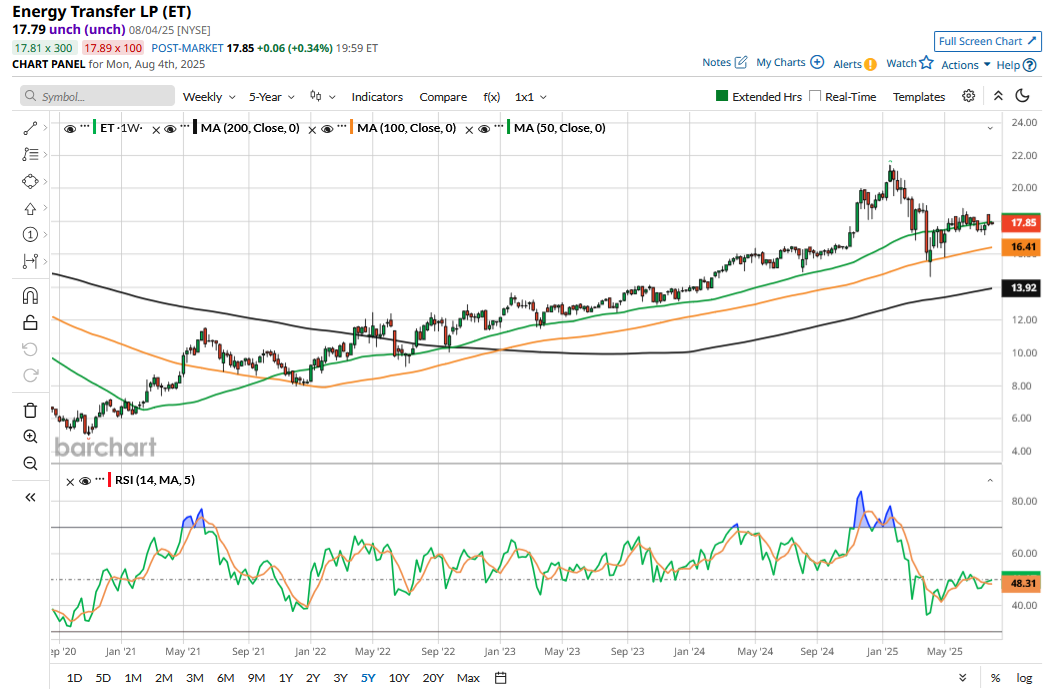

Energy Transfer (ET) stock is having a dismal run in 2025 and is down 9.2% for the year. The stock has underperformed many of its midstream peers, and its return trails the Alps Alerian MLP ETF (AMLP), which is in the green this year.

One source of comfort for Energy Transfer investors has been its high dividend yield, which currently stands at almost 7.5% after the company announced an increase in its quarterly payout last month. In this article, we’ll explore whether ET stock is ready for a rebound after the frustrating YTD underperformance.

The Case for Midstream Energy Companies

To begin with, let’s build an investment case for midstream companies that are primarily involved in the transportation, storage, and processing of energy products. While the midstream energy industry does not witness outsized growth, two drivers could help support higher growth over the next few years. The first is artificial intelligence (AI), where tech companies are increasing their investments, including towards power-guzzling data centers, which looks like a structural tailwind for the energy sector.

The second is President Donald Trump’s trade and tariff policy. The U.S. is looking to push defense and energy exports in a bid to bridge the trade deficit with trading partners with whom it has a large deficit. We saw this play out with the E.U., and something similar could be on the table as the U.S. eventually signs a trade deal with China and India, two of the world’s biggest energy importers.

However, despite the seemingly positive fundamentals, midstream energy stocks haven’t really rallied in 2025. This is in part due to the outperformance last year, where midstream stocks, including ET, delivered strong returns in anticipation of favorable policies under the Trump administration.

While midstream stocks in general are having a tepid year, ET's underperformance stands out. For midstream companies like Energy Transfer, incremental growth comes either from acquisitions or new growth projects. ET reported a 13% year-over-year rise in its 2024 earnings before interest, tax, depreciation, and amortization (EBITDA), which was primarily led by the acquisition of Crestwood Equity Partners and WTG Midstream. However, the company expects its EBITDA growth to be 5% at the midpoint for 2025, as there wasn’t any bump from inorganic growth as we saw last year.

Should You Buy the Recent Weakness in Energy Transfer Stock?

That said, ET’s growth should revive over the next few quarters. The company expects to spend $5 billion on growth capex in 2025, which is significantly higher than the previous year. The majority of these projects will come online next year, and their earnings will ramp up in 2026 and 2027. Energy Transfer expects its growth to stay strong through the end of this decade as the company invests to expand its portfolio.

Specifically, the Nederland Flexport expansion project would enhance Energy Transfer’s export capabilities. The company expects to commence ethylene export service from the Nederland Terminal in the final quarter of this year.

ET stock trades at a forward enterprise value-to-EBITDA multiple of 8.6x, which I find quite reasonable, especially in light of its strong balance sheet and expected growth on the back of demand from AI and energy export opportunities.

ET Stock Forecast

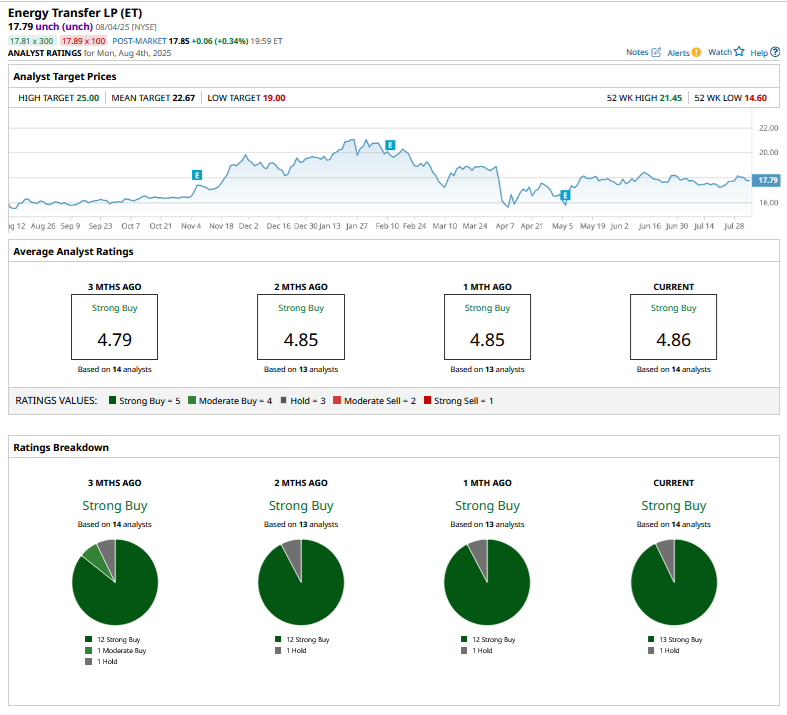

Brokerages also seem to agree that ET stock is undervalued here. Last month, TD Cowen analyst Jason Gabelman initiated coverage on the stock with a “Buy” rating and $22 target price, saying the stock trades at "undemanding levels.”

Most sell-side peers are on the same page as Gabelman, and of the 14 analysts covering ET, 13 rate it as a “Strong Buy” and 1 as a “Hold.”

Energy Transfer has a mean target price of $22.67, with a Street-high target price of $25. ET even trades below its Street-low target price of $19, a reflection on how beaten-down the stock has been this year.

Overall, I believe that after the YTD underperformance, Energy Transfer stock could play a catch-up trade with peers, which, coupled with the healthy 7.5% dividend yield, could imply double-digit annualized returns for the next couple of years from here.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.