Centene Stock: Is Wall Street Bullish or Bearish?

/Centene%20Corp_%20logo%20and%20meds-by%20Formatoriginal%20via%20Shutterstock.jpg)

Centene Corporation (CNC), headquartered in Saint Louis, Missouri, operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations. Valued at $12.7 billion by market cap, the company’s specialty services include Medicaid and medicare health plans, treatment compliance, and nurse triage.

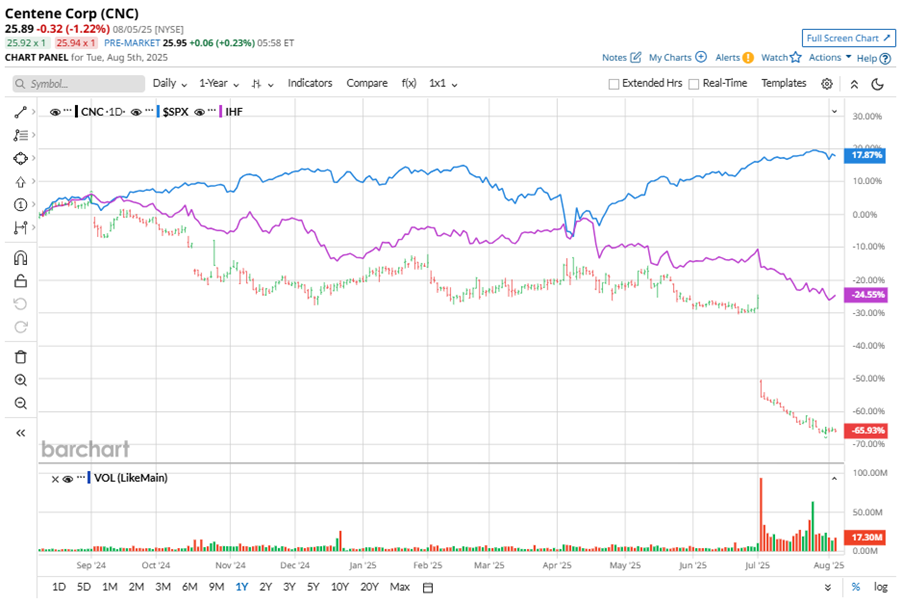

Shares of this largest Medicaid managed care organization have significantly underperformed the broader market over the past year. CNC has declined 66.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 21.5%. In 2025, CNC stock is down 57.3%, compared to the SPX’s 7.1% gains on a YTD basis.

Narrowing the focus, CNC’s underperformance is also apparent compared to the iShares U.S. Healthcare Providers ETF (IHF). The exchange-traded fund has dropped about 24.3% over the past year. Moreover, ETF’s 13.2% losses on a YTD basis outshine the stock’s dip over the same time frame.

Centene's underperformance was due to increased healthcare utilization and medical cost pressures, resulting in the company's first quarterly loss in over a decade. The health benefits ratio spiked to 93%, the highest in years, and revenues were impacted by a shortfall in anticipated risk adjustment transfer payments. Centene also faced higher-than-expected utilization rates in its Medicaid and Medicare Advantage lines of business, leading to a decrease in membership and weak quarterly earnings.

On Jul. 25, CNC shares closed up more than 6% after reporting its Q2 results. Its adjusted losses of $0.16 per share did not meet Wall Street's expectations of EPS of $0.68. The company’s revenue was $48.7 billion, surpassing Wall Street forecasts of $43.9 billion.

For the current fiscal year, ending in December, analysts expect CNC’s EPS to decline 77.3% to $1.63 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

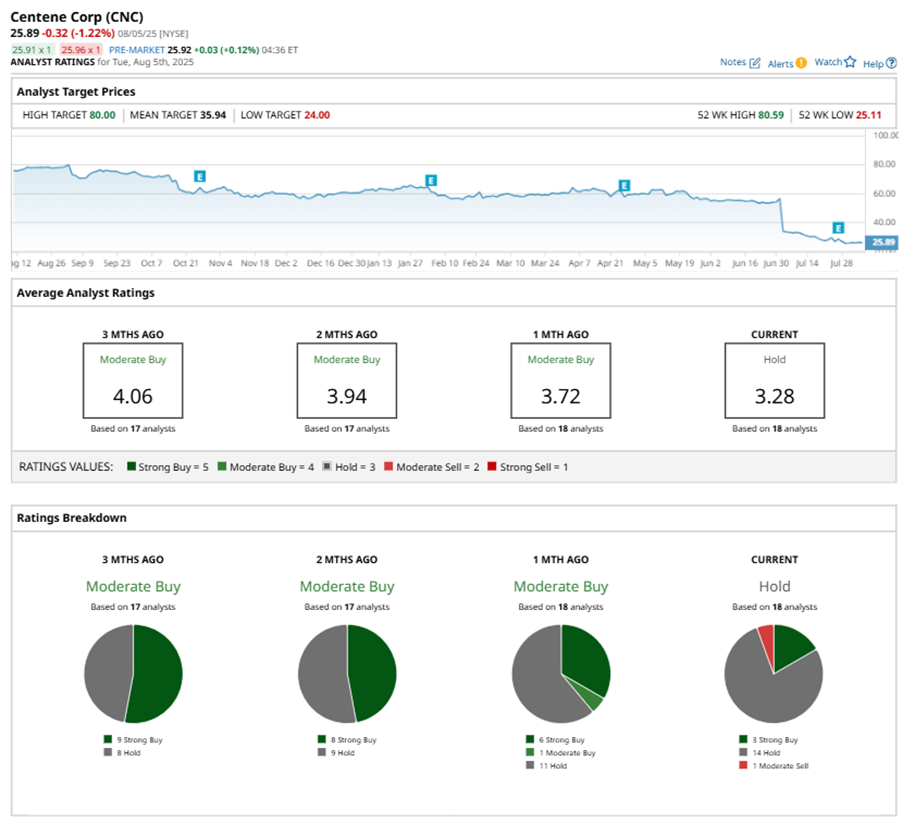

Among the 18 analysts covering CNC stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, 14 “Holds,” and one “Moderate Sell.”

This configuration is less bullish than a month ago, with an overall rating of “Moderate Buy,” consisting of six analysts suggesting a “Strong Buy,” and one recommending a “Moderate Buy.”

On Aug. 4, Morgan Stanley (MS) analyst Erin Wright kept an “Equal Weight” rating on CNC and lowered the price target to $28, implying a potential upside of 8.1% from current levels.

The mean price target of $36.25 represents a 38.8% premium to CNC’s current price levels. The Street-high price target of $80 suggests an ambitious upside potential of 209%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.