What to Expect From PPL Corporation's Next Quarterly Earnings Report

PPL Corporation (PPL), headquartered in Allentown, Pennsylvania, provides electricity and natural gas to approximately 3.6 million customers. Valued at $26.6 billion by market cap, the company generates electricity from power plants, as well as markets wholesale and retail energy and natural gas. It also delivers natural gas to customers in Kentucky and Rhode Island and generates electricity from power plants in Kentucky. The leading utility company is expected to announce its fiscal second-quarter earnings for 2025 before the market opens on Thursday, Jul. 31.

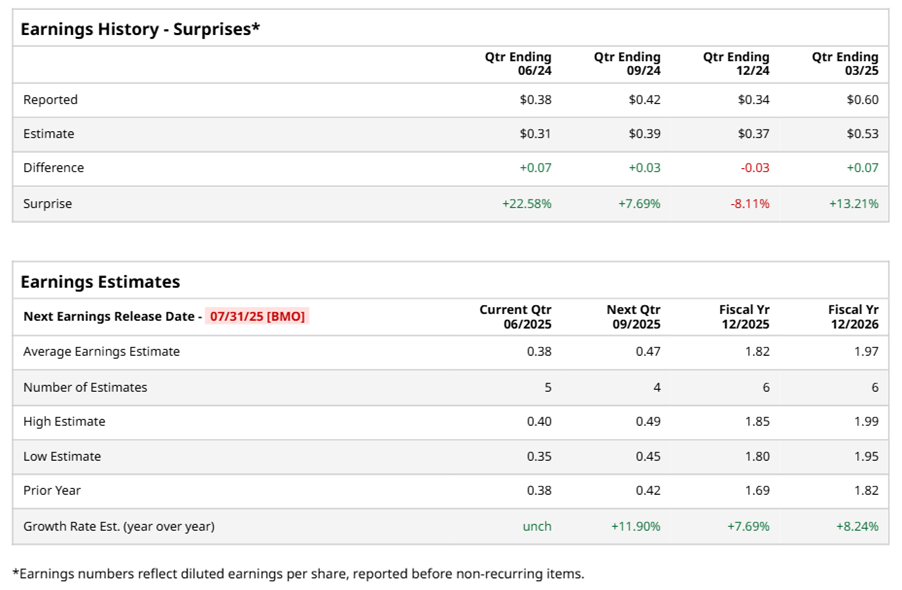

Ahead of the event, analysts expect PPL to report a profit of $0.38 per share on a diluted basis, unchanged from the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect PPL to report EPS of $1.82, up 7.7% from $1.69 in fiscal 2024. Its EPS is expected to rise 8.2% year-over-year to $1.97 in fiscal 2026.

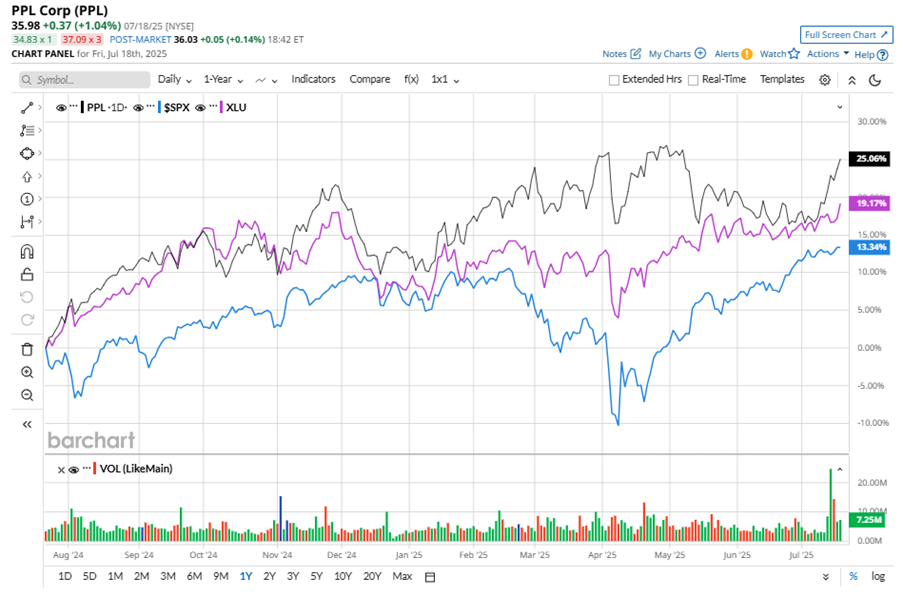

PPL stock has outperformed the S&P 500 Index’s ($SPX) 13.6% gains over the past 52 weeks, with shares up 25.3% during this period. Similarly, it outperformed the Utilities Select Sector SPDR Fund’s (XLU) 19.6% gains over the same time frame.

PPL has formed a joint venture with Blackstone Inc. (BX) Infrastructure to build gas-fired generation stations for data centers under long-term energy services agreements. This move aligns with U.S. policies that promote domestic manufacturing and the reshoring of tech infrastructure. The JV targets high data center interest areas and anticipates significant demand growth. PPL is investing in grid modernization and transmission infrastructure to meet this demand and strengthen reliability. These investments are expected to drive earnings growth and improve customer service. The company's focus on reliability has led to fewer power outages. Overall, PPL's strategic investments position it well for future growth in the data center market.

On Apr. 30, PPL shares closed up marginally after reporting its Q1 results. Its adjusted EPS of $0.60 surpassed Wall Street expectations of $0.53. The company’s revenue was $2.5 billion, beating Wall Street forecasts of $2.4 billion. PPL expects full-year adjusted EPS in the range of $1.75 to $1.87.

Analysts’ consensus opinion on PPL stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of 15 analysts covering the stock, 10 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and four give a “Hold.” PPL’s average analyst price target is $38.20, indicating a potential upside of 6.2% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.